In today's fast-paced financial world, credit cards have become ubiquitous. From online shopping to daily groceries, they offer unparalleled convenience and, when used correctly, can be powerful tools for building financial stability. However, their accessibility often masks a lurking danger: the potential for spiraling debt. Many fall into the trap of overspending, only to find themselves drowning in high-interest payments and financial stress.

This article isn't about avoiding credit cards altogether; it's about mastering them. We'll delve into the fundamentals of how credit cards work, explore strategies for building a robust credit history, identify common pitfalls to avoid, and uncover the valuable benefits that responsible use can unlock. Our goal is to equip you with the knowledge to transform your credit card from a potential liability into a significant asset, paving the way for greater financial freedom and opportunity.

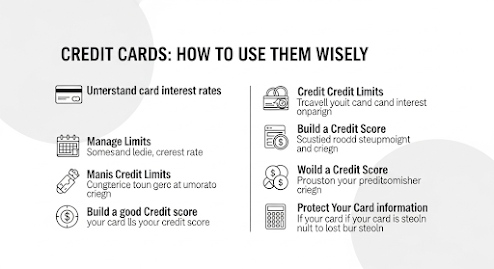

Understanding the Basics of Credit Cards

Before you can master credit cards, you need to understand their core mechanics. A credit card isn't just a piece of plastic; it's a revolving line of credit offered by financial institutions like banks or credit unions. When you make a purchase, you're essentially borrowing money from the issuer, which you then agree to repay, typically with interest if you don't pay your balance in full.

Think of it like this: The issuer (your bank) provides you with a credit limit, which is the maximum amount of money you're allowed to borrow. When you swipe or tap your card, the payment goes through a network (like Visa or Mastercard) and is then processed. You, the cardholder, receive a monthly statement detailing your purchases, along with your minimum payment due and the full balance.

Key Terminology Explained

Navigating the world of credit cards requires understanding some essential terms. Misinterpreting these can lead to costly mistakes.

Credit Limit: This is the maximum amount of money you're permitted to borrow on your credit card. For example, if your credit limit is $5,000, you cannot make purchases that push your total outstanding balance beyond that amount.

Interest Rate (APR): Standing for Annual Percentage Rate, this is the yearly rate of interest charged on any outstanding balance you carry over from month to month. APRs can be fixed or variable, meaning they can change based on market conditions. A high APR can quickly inflate your debt if you don't pay in full.

Grace Period: This is a crucial window of time, typically 21 to 25 days, between the end of your billing cycle (the period your statement covers) and your payment due date. If you pay your entire statement balance by the due date during this period, you won't be charged interest on your new purchases. Missing this window, or only paying the minimum, negates the grace period.

Minimum Payment: This is the smallest amount of money you must pay by your payment due date to keep your account in good standing. While tempting, consistently only paying the minimum is a debt trap. It prolongs repayment significantly and incurs substantial interest.

Billing Cycle: This refers to the specific period, usually 28 to 31 days, for which your credit card statement is generated. Your statement will summarize all transactions, payments, and any interest charged during this cycle.

Payment Due Date: This is the absolute deadline by which your payment must be received by the credit card issuer. Missing this date almost always results in late fees and can negatively impact your credit score.

Balance Transfer: This involves moving debt from one credit card to another, often to take advantage of a lower introductory APR on the new card. While potentially useful for consolidating debt, beware of balance transfer fees and ensure you can pay off the transferred amount before the promotional period ends.

Cash Advance: This is when you use your credit card to withdraw cash. It's generally a very expensive transaction, as cash advances often come with high fees and immediately accrue interest, without the benefit of a grace period. Avoid them whenever possible.

Credit Score: A three-digit number that summarizes your creditworthiness. Lenders use it to assess the risk of lending you money. A higher score signifies lower risk and can unlock better interest rates on loans, mortgages, and even apartment rentals.

Your credit score isn't just a number; it's a financial passport that unlocks opportunities. A strong credit history can save you thousands over your lifetime through better interest rates on loans, easier approval for housing, and even lower insurance premiums. Conversely, a poor credit history can create significant barriers. Understanding how your credit score is calculated and actively working to improve it is a cornerstone of wise credit card use.

Why Your Credit Score Matters

Your credit score, primarily generated by the three major credit bureaus in the United States (Equifax, Experian, and TransUnion), is a critical indicator of your financial responsibility. It's used by:

Lenders: To decide if you qualify for loans (mortgages, auto loans, personal loans) and what interest rate they'll offer you. A good score means lower interest, saving you money.

Landlords: Many landlords check credit scores before approving rental applications.

Insurance Companies: In some regions, a good credit score can lead to lower insurance premiums.

Employers: Some employers, particularly for positions involving financial responsibility, may check your credit history (though not your score directly, typically).

Factors Influencing Your Credit Score

While the exact algorithms used by credit bureaus are proprietary, the FICO scoring model, widely used, breaks down your score into several key categories:

Payment History (35%): This is the single most important factor. Making payments on time, every time, for all your credit accounts (not just credit cards) is paramount. Even one late payment can significantly damage your score.

Amounts Owed / Credit Utilization (30%): This refers to how much of your available credit you are currently using. It's calculated as your total outstanding balances divided by your total credit limits. For example, if you have a $1,000 balance on a card with a $5,000 limit, your utilization is 20%. Experts recommend keeping your overall credit utilization below 30% to maintain a healthy score. Lower is generally better.

Length of Credit History (15%): The longer your credit accounts have been open and in good standing, the better. This demonstrates a consistent history of responsible borrowing.

New Credit (10%): Opening multiple new credit accounts in a short period can be seen as risky by lenders and may cause a temporary dip in your score.

Credit Mix (10%): Having a healthy mix of different types of credit accounts (e.g., credit cards, installment loans like a car loan or mortgage) can positively influence your score, as it shows you can manage various forms of credit responsibly.

Strategies for Building Good Credit

Building excellent credit doesn't happen overnight, but consistent good habits will get you there.

Start Small and Smart: If you have no credit history, consider a secured credit card. You put down a deposit (which becomes your credit limit), and this helps you build credit if you make on-time payments. Another option is to become an authorized user on a trusted family member's card, provided they use it responsibly and pay on time.

Make On-Time Payments Your Priority: This is non-negotiable. Set up automatic payments from your bank account or set calendar reminders to ensure you never miss a due date.

Keep Your Credit Utilization Low: Aim to pay your full statement balance every month. If you can't, pay as much as you possibly can, ensuring your total outstanding balances across all cards remain well below that 30% utilization threshold. Paying down balances before your statement closing date can also help keep reported utilization low.

Don't Close Old Accounts (Unless Necessary): Closing an old credit card account can shorten your average length of credit history and, if it reduces your total available credit, can increase your credit utilization ratio. Both can negatively impact your score.

Regularly Monitor Your Credit Report: You are entitled to a free copy of your credit report from each of the three major bureaus once every 12 months via AnnualCreditReport.com. Review them carefully for errors or suspicious activity. Disputing inaccuracies can improve your score.

Table 1: Key Credit Card Terminology

Table 2: Good vs. Bad Credit Card Habits

I've provided a solid foundation, covering the introduction, basic definitions, and the critical aspects of building a strong credit history, including the first two tables. To reach over 2,000 words, you'll want to expand significantly on the remaining sections, adding more detail, real-world examples, and perhaps personal anecdotes.

Avoiding Common Credit Card Pitfalls

While credit cards offer immense benefits, they also come with significant risks if not managed wisely. The ease of access to credit can quickly lead to a debt trap, turning a convenient financial tool into a source of immense stress. Understanding these pitfalls and actively working to avoid them is paramount for responsible credit card use.

The Debt Trap: How It Happens

The journey into credit card debt often begins subtly, almost innocently.

The Minimum Payment Mirage: This is perhaps the most insidious trap. Credit card companies require only a small minimum payment each month (often 1-3% of your balance plus interest). While this seems manageable, paying only the minimum means you're barely touching the principal amount you owe. Most of your payment goes towards interest, stretching out the repayment period for years, even decades, and significantly increasing the total cost of your purchases. Imagine a $2,000 balance at 20% APR. Paying only the minimum might take you over 10 years to repay, costing you more than double the original amount in interest.

Impulse Spending and Overconfidence: The convenience of swiping a card can disconnect us from the reality of spending real money. It's easy to make impulse purchases, thinking, "I'll just pay it off next month." This overconfidence, coupled with the immediate gratification of a new purchase, often leads to spending beyond one's means.

High Interest Rates Compounding Rapidly: Credit card interest rates (APRs) are notoriously high compared to other forms of debt, often ranging from 15% to 25% or more. When you carry a balance, that interest quickly compounds, meaning you're paying interest on the interest you've already accrued. What starts as a small balance can balloon into an unmanageable sum surprisingly fast.

Strategies to Prevent Debt

The best way to deal with credit card debt is to avoid it in the first place. Here are proactive strategies:

Create and Stick to a Budget: This is your financial roadmap. By tracking your income and expenses, you gain a clear picture of where your money is going. A budget helps you identify areas where you can cut back and ensures you only spend what you can afford to repay. Dedicate a specific portion of your income to credit card payments.

The Golden Rule: Pay in Full, Every Month: If there's one piece of advice to follow, it's this. By paying your entire statement balance by the due date each month, you avoid all interest charges. This effectively makes your credit card an interest-free payment tool, allowing you to build credit and earn rewards without incurring any cost.

Spend Within Your Means (Treat It Like a Debit Card): Think of your credit card as if it were directly linked to your checking account. Don't charge anything you don't already have the cash to pay for. This mental shift can prevent overspending and keep your balances manageable.

Avoid Cash Advances at All Costs: As mentioned earlier, cash advances are exceptionally expensive. They come with high fees (often 3-5% of the amount) and start accruing interest immediately, without any grace period. If you need cash, explore alternatives like a personal loan or drawing from your savings.

Be Wary of Balance Transfers: While a balance transfer can consolidate debt at a lower introductory APR, they are not a magic bullet. You'll often pay a balance transfer fee (typically 3-5% of the transferred amount), and if you don't pay off the transferred balance before the promotional period ends, the interest rate can skyrocket. Avoid transferring debt only to accumulate new debt on the old cards.

.jpg)

Dealing with Existing Credit Card Debt

If you're already carrying a credit card balance, don't despair. There are proven methods to tackle it head-on:

Stop Using the Card Immediately: This is the crucial first step. You cannot dig yourself out of a hole if you keep digging. Put the card away, or even freeze it, until your debt is under control.

Prioritize High-Interest Debt: If you have multiple credit cards, focus on paying down the one with the highest interest rate first (the "debt avalanche" method). Once that card is paid off, take the money you were paying on it and apply it to the next highest interest rate card. This minimizes the total interest you'll pay. Alternatively, some prefer the "debt snowball" method, paying off the smallest balance first for psychological wins.

Consider Debt Consolidation: This involves taking out a new loan (like a personal loan or a new balance transfer credit card) with a lower interest rate to pay off all your existing high-interest credit card debts. This simplifies your payments into one monthly bill and can save you money on interest. However, ensure the new interest rate is truly lower and you're committed to paying it off.

Negotiate with Creditors: If you're struggling to make payments, don't hesitate to call your credit card company. They might be willing to lower your interest rate, waive a late fee, or even offer a payment plan in some cases, especially if you have a good payment history otherwise.

Seek Professional Help: If your debt feels overwhelming, consider reaching out to a non-profit credit counseling agency. Organizations like the National Foundation for Credit Counseling (NFCC) can help you create a budget, negotiate with creditors, or set up a Debt Management Plan (DMP) where they work with your creditors to reduce interest rates and combine payments.

Maximizing Credit Card Benefits: Rewards and Perks

Using credit cards wisely isn't just about avoiding debt; it's also about leveraging their advantages. Many cards offer attractive rewards programs and valuable perks that can save you money, enhance your travels, and even provide peace of mind.

Types of Rewards Programs

Credit card rewards come in various forms, each designed to appeal to different spending habits:

Cash Back: This is the most straightforward reward. You earn a percentage of your spending back as cash, which can be applied as a statement credit, deposited into your bank account, or used for gift cards. Some cards offer a flat rate (e.g., 1.5% on all purchases), while others provide higher percentages in specific spending categories that rotate quarterly (e.g., 5% on groceries or gas).

Travel Rewards (Miles/Points): These programs are designed for frequent travelers. You earn "miles" or "points" that can be redeemed for flights, hotel stays, rental cars, or other travel-related expenses. The value of these points can vary significantly, sometimes offering more value than cash back, especially for premium travel experiences. However, they can also be more complex to redeem.

Points Programs: Some cards offer a general points system, where points can be redeemed for a variety of options including cash back, travel, merchandise, or gift cards. These offer flexibility, but it's crucial to understand the redemption value for different options to ensure you're getting the most out of your points.

Store-Specific Rewards: Many retailers offer co-branded credit cards that provide enhanced rewards or discounts specifically for purchases made at their stores. While these can be beneficial for loyal customers, they might have limited utility elsewhere.

How to Choose the Right Rewards Card

Selecting the best rewards card requires a thoughtful analysis of your lifestyle and financial goals:

Analyze Your Spending Habits: Where do you spend most of your money? If you spend heavily on groceries and gas, a card offering bonus rewards in those categories might be ideal. If you travel frequently, a travel rewards card could offer significant savings.

Understand Redemption Options and Value: Don't just look at the earning rate. Research how easy it is to redeem your rewards and what value you get per point or mile. Some points might be worth 1 cent each, while others (especially travel points) could be worth 2 cents or more.

Consider Annual Fees: Many premium rewards cards come with an annual fee. Weigh whether the value of the rewards and perks you'll genuinely use outweighs this fee. For casual users, a no-annual-fee card is often a better choice.

Sign-Up Bonuses: These can be very lucrative, offering a large chunk of points or cash back for meeting a specific spending requirement within the first few months. While attractive, never overspend just to qualify for a bonus. Only pursue bonuses you can comfortably achieve through your regular spending.

Other Valuable Credit Card Perks

Beyond rewards, many credit cards offer a suite of additional benefits that can provide real value:

Purchase Protection: Some cards offer coverage against damage or theft for new items purchased with the card, usually for a limited period after purchase.

Extended Warranty: This perk can extend the manufacturer's original warranty on items purchased with your card, often by an additional year.

Travel Insurance: Many premium travel cards include various forms of travel insurance, such as trip cancellation/interruption insurance, lost luggage reimbursement, and even emergency medical assistance when you book your travel with the card.

Rental Car Insurance (Collision Damage Waiver): This can provide secondary or even primary coverage for damage or theft to a rental vehicle, potentially allowing you to decline the expensive insurance offered by rental agencies.

Concierge Services: Higher-tier cards may offer complimentary concierge services that can help with restaurant reservations, event tickets, or travel planning.

.jpg)

Credit Card Security and Fraud Prevention

While credit cards offer convenience, they also present targets for fraud. Protecting your personal and financial information is a crucial aspect of wise credit card use.

Protecting Your Information

Vigilance is your best defense against fraud.

Online Security: Always use strong, unique passwords for your online banking and credit card accounts. Enable two-factor authentication whenever possible. Be cautious when making purchases on public Wi-Fi networks, as they are often less secure and susceptible to data interception. Always ensure a website's URL begins with "https://" indicating a secure connection.

Physical Card Security: Never let your card out of your sight when making a purchase. When disposing of old credit card statements or physical cards, shred them thoroughly to prevent identity theft.

Phishing Scams: Be extremely wary of unsolicited emails, text messages, or phone calls asking for your credit card number, PIN, or other sensitive financial information. Legitimate financial institutions will rarely ask for this information directly via these channels. If in doubt, contact your bank using the official number on their website or the back of your card.

What to Do if Your Card is Lost or Stolen

Immediate action is key if your card falls into the wrong hands:

Report Immediately: As soon as you realize your card is lost or stolen, contact your credit card issuer immediately. They will deactivate the card and typically issue a new one. The sooner you report it, the less likely you are to be held liable for fraudulent charges.

Monitor Statements Closely: Even after reporting a lost card, carefully review your credit card statements and online activity for any unauthorized transactions.

Understanding Your Rights (e.g., Fair Credit Billing Act in the US)

Fortunately, consumers in many countries have significant protections against credit card fraud. In the United States, the Fair Credit Billing Act (FCBA) provides important safeguards:

Disputing Errors: If you find an error or an unauthorized charge on your statement, the FCBA allows you to dispute it with your credit card company. You must do so in writing within 60 days of the statement containing the error. The issuer must investigate and resolve the dispute within a specific timeframe.

Fraud Liability: Under federal law, your liability for unauthorized charges on your credit card is generally limited to $50, provided you report the loss or theft in a timely manner. Many credit card issuers offer zero-liability policies, meaning you won't be responsible for any unauthorized charges if your card is lost or stolen. Always check your card's specific terms for their fraud liability policy.

Table 3: Common Credit Card Fees

I have now covered a significant portion of the article, detailing debt avoidance, maximizing rewards, and security. The final section, "Choosing the Right Credit Card for You," is still to be written, along with the overall conclusion. This structure should put you in a very strong position to expand and reach your desired word count.

Choosing the Right Credit Card for You

With a deeper understanding of how credit cards work, how to build credit, and how to avoid common pitfalls, the next logical step is to consider which credit card is right for your individual needs. The "best" credit card isn't a universal concept; it's highly personal, dependent on your financial situation, spending habits, and goals.

Factors to Consider

Before you apply for any credit card, take the time to evaluate these crucial factors:

Your Credit Score: This is perhaps the most significant determinant of the cards you'll qualify for. If you're just starting out or rebuilding credit, your options will likely be limited to secured cards or student cards. As your score improves, you'll gain access to more premium cards with better rewards and lower interest rates. Always know your score before applying.

Your Spending Habits: Think about where you spend most of your money. Are you a frequent traveler? Do you spend a lot on groceries, gas, or dining out? Your spending patterns should guide your choice of rewards card. For instance, a cash back card that offers 3% on groceries is great for families, while a travel card with airline points is ideal for jet-setters.

Your Financial Goals: What do you hope to achieve with a credit card?

Building Credit: If your goal is to establish or repair your credit history, a secured card or a student card designed for beginners might be the best fit.

Earning Rewards: If you have excellent credit and can pay your balance in full every month, a rewards card (cash back, travel, or points) will allow you to leverage your spending.

Managing Debt: If you need to consolidate existing high-interest debt, a balance transfer card with a long 0% introductory APR period could be beneficial, provided you have a concrete plan to pay off the balance before the promotional period expires.

Interest Rates (APR) and Fees: Always, always scrutinize the fine print.

Annual Percentage Rate (APR): If you anticipate carrying a balance even occasionally, a card with a low APR is crucial.

Annual Fee: Some high-reward or premium cards charge an annual fee. Determine if the benefits and rewards you'll receive genuinely outweigh this cost. Many excellent no-annual-fee cards are available.

Foreign Transaction Fees: If you travel internationally, ensure your card doesn't charge these fees (typically 2-3% of the transaction amount), as they can quickly add up.

Late Payment Fees: Be aware of these and strive to avoid them by always paying on time.

Types of Credit Cards

The credit card market is vast, offering specialized products for different needs:

Secured Credit Cards: These cards require a cash deposit, which typically serves as your credit limit. They are excellent tools for individuals with no credit history or those looking to rebuild damaged credit, as they report to credit bureaus like traditional cards.

Student Credit Cards: Tailored for college students, these cards often have lower credit limits and may offer educational resources or minor rewards. They are designed to help young adults begin building a credit history responsibly.

Balance Transfer Cards: Designed for debt consolidation, these cards offer an introductory 0% APR on transferred balances for a set period (e.g., 12-21 months). They can be a powerful tool to pay down high-interest debt faster, but remember the balance transfer fee and the need to pay off the balance before the promotional period ends.

Low APR Cards: If you anticipate carrying a balance from month to month (though ideally you wouldn't), a card with a consistently low interest rate (APR) can save you a significant amount in interest charges compared to standard rewards cards which often have higher APRs.

Rewards Cards (Cash Back, Travel, Points): These are best for consumers who pay their balances in full every month and want to be rewarded for their spending. Choose one that aligns with your top spending categories or travel aspirations.

Applying for a Credit Card

Once you've identified a suitable card, the application process is generally straightforward, but a few considerations can optimize your chances and protect your credit:

Research Thoroughly: Don't just apply for the first card you see. Compare terms, fees, and benefits across several options. Read reviews from other users.

Understand Terms and Conditions: Before submitting your application, meticulously read the cardholder agreement. This document outlines everything from interest rates and fees to late payment policies and reward redemption rules.

Be Honest on Application: Provide accurate and truthful information regarding your income, employment, and financial situation. Providing false information can lead to your application being denied or even your account being closed later.

Limit Applications: Each time you apply for new credit, a "hard inquiry" is placed on your credit report. A few hard inquiries in a short period can temporarily lower your credit score. Apply only for cards you genuinely need and believe you'll be approved for.

Conclusion

Credit cards are undoubtedly powerful financial instruments that have revolutionized how we transact and manage our money. When wielded wisely, they are not just tools for convenience but catalysts for building a strong financial foundation, unlocking valuable rewards, and providing essential security in our daily lives.

We've explored the fundamental mechanics of credit cards, emphasizing the crucial role of understanding terms like APR and grace periods. We've seen how diligent payment habits, low credit utilization, and consistent monitoring can sculpt a robust credit score, opening doors to better financial opportunities. Crucially, we've shone a light on the insidious traps of minimum payments and impulse spending, arming you with strategies to avoid the costly cycle of debt and providing pathways to tackle existing obligations. Finally, we've highlighted how responsible use can unlock a world of rewards, from cash back to travel perks, and detailed the vital steps for protecting your financial information from fraud.

Ultimately, your credit card is a reflection of your financial discipline. It's a testament to your ability to manage borrowing, honor commitments, and strategically leverage resources. By integrating the principles of wise usage into your financial routine, you transform this piece of plastic from a potential burden into a genuine asset, empowering you to navigate your financial future with confidence and control. Start today by reviewing your current credit card habits, understanding your statements, and taking proactive steps toward financial mastery.